Engineering the Architecture of Organizational Decision Making

Moving from unstructured "gut feel" to engineered consistency.

At a fundamental level, a large part of a corporation can be described as a decision-making engine. An organization's performance is effectively the aggregate output of hundreds or thousands of choices made daily, from strategic capital allocation in the C-suite to operational triage on the front lines.

Financial Performance Differential

Driven specifically by decision effectiveness between competitors.

Faster Execution

Research shows structured decision processes yield 75% better choices in half the time.

However, a significant challenge facing modern companies is that decision-making processes have not evolved in step with data capabilities. While operations, sales, and marketing have been rigorously optimized, the act of choosing remains largely unstructured. High-stakes decisions often occur in fragmented communication channels or rely on the intuition of overloaded executives. This introduces noise and cognitive bias into the strategic process.

"The combination of cognitive biases, limited attention spans, and our tendency to overestimate our abilities in areas we know little about add up to an insidious tendency towards bad judgment. We think we are great decision makers. And since we rarely write our decisions down and check them later, it’s easy to keep convincing ourselves that we’re right."

The Feedback Loop Gap: This reinforces the critical missing link in many modern businesses. Without writing decisions down to audit them later, organizations are operating without a feedback loop, effectively blind to their own error rates. And even when those decisions are recorded, there is a lack of ability to properly exploit this data.

The Importance of Structured Logic

A major impediment to organizational intelligence is not a lack of data, but a lack of structural discipline. Improvement requires measurement, and measurement requires a record. Currently, most decisions are treated as ephemeral events rather than permanent assets.

To construct a robust intelligent organization, capturing the outcome is insufficient. The requirement is to capture the process: the structured rationale, the weighted variables, the risk assessment, and the predictive logic that precipitated the choice. Without this, an organization remains in a state of perpetual amnesia, unable to compound its institutional knowledge.

Introducing SAGE

A Decision Intelligence Infrastructure

SAGE was engineered to bridge this gap. It is not a vertical-specific tool, but a generic decision-making engine designed to introduce scientific rigor, consistency, and scalability to human judgment.

The objective is not to replace human experts with opaque "black box" algorithms, but to augment them with an infrastructure that filters noise, structures unstructured inputs, and enforces logical consistency.

The Science Behind SAGE

SAGE functions on a foundation of coordinated agentic systems. Rather than a simple linear interaction with a Large Language Model (LLM), SAGE utilizes a multi-step reasoning architecture which increases its ability to detect patterns and improve the quality of its outputs.

The system combines specialized AI agents with deterministic logic modules that operate within a coordinated framework. These components effectively emulate an analysis of the data from orthogonal perspectives, and synthesize information through structured logic. This approach ensures that the output is not merely a probabilistic guess, but the result of a rigorous, multi-stage validation process aligned with defined strategic criteria.

Unlocking Competitive Advantage: SAGE in Practice

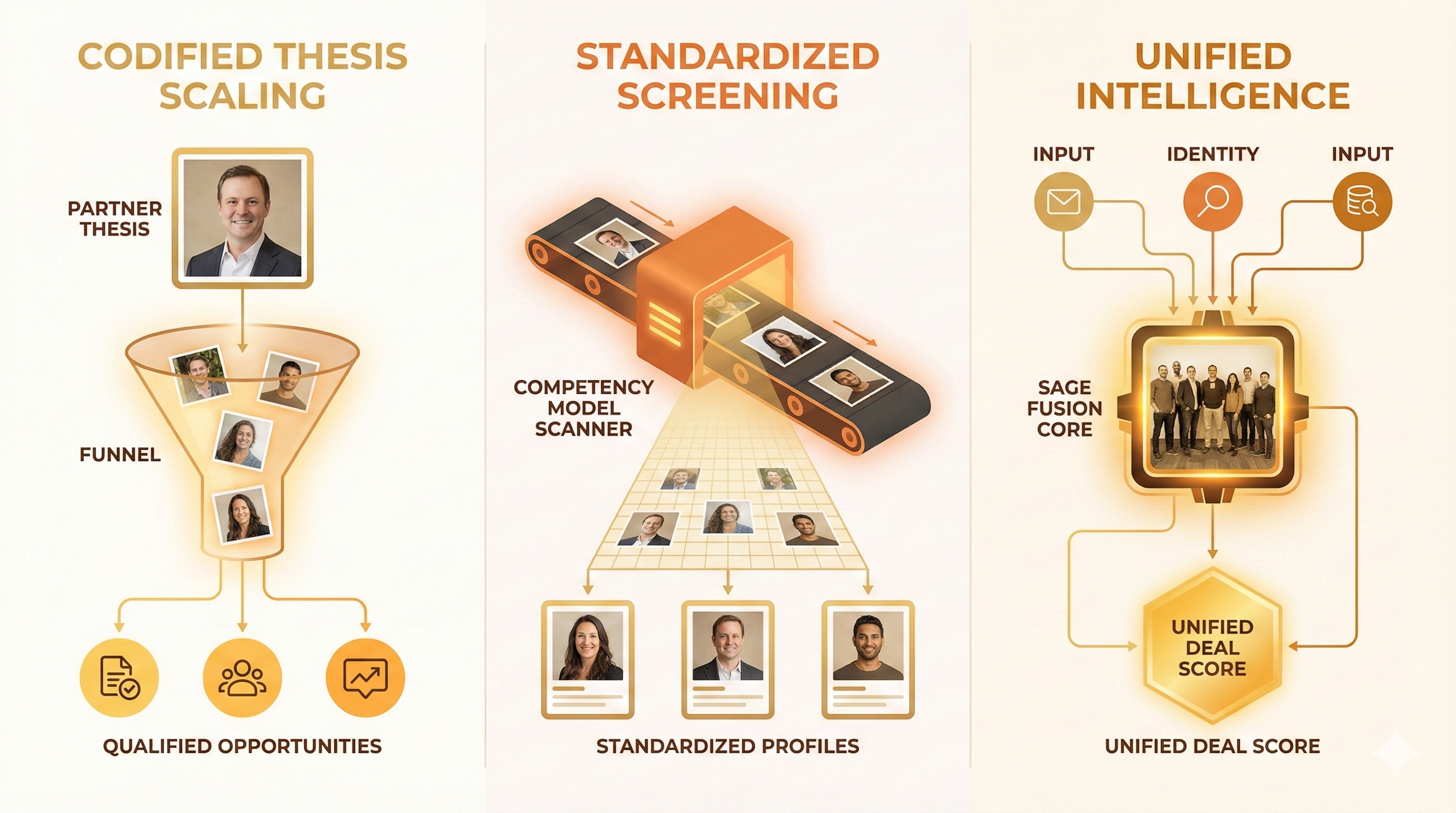

1. Venture Capital Deal Screening

Scenario: Junior analysts screening complex technology deals for Investment Partners.

The Status Quo

The Experience Gap: Junior analysts lack the decades of pattern recognition that Partners possess. They often miss subtle red flags or pass on non-obvious opportunities.

Inefficient Feedback: Senior Partners must spend valuable time correcting basic analysis rather than focusing on strategic value.

Subjective Filtering: Deals are often filtered based on the individual analyst's limited perspective rather than the firm's collective thesis.

The SAGE Edge

Institutional Thesis: SAGE evaluates every deck using the firm's specific expertise, effectively allowing the Partner's logic and knowledge to scale to every screen.

Augmented Judgment: Juniors are provided with a structured analysis that highlights what a Partner would look for, accelerating their training.

Standard of Quality: Ensures every deal is judged by the firm's highest standard of expertise, avoiding the variability of junior-level reviews.

2. High-Volume Talent Acquisition

Scenario: Recruiters processing thousands of applications for open roles.

The Status Quo

Cognitive Fatigue: After reviewing 50 resumes, human attention degrades. The quality of screening for the 51st candidate is significantly lower than the 1st.

Inconsistent Criteria: Decisions fluctuate based on the recruiter's mood, time of day, or recent interactions, leading to bias.

Speed vs. Quality: Teams are forced to rush through resumes to meet quotas, resulting in high rejection rates of qualified candidates (false negatives).

The SAGE Edge

Infinite Bandwidth: SAGE evaluates thousands of applications without fatigue. The 1,000th candidate receives the exact same level of scrutiny as the 1st.

Engineered Consistency: Every candidate is measured against the exact same competency model, eliminating temporal bias.

Evidence Extraction: The system automatically surfaces evidence of skills from unstructured text, allowing recruiters to focus on interviewing, not reading.

3. Complex Real Estate Underwriting

Scenario: Investment committees analyzing opportunities across different geographies.

The Status Quo

Siloed Intelligence: Teams in different regions make decisions independently. Insights learned in one market (e.g., specific zoning risks) are not structurally shared with others.

Data Fragmentation: Comparing opportunities is difficult because data arrives in non-standardized formats (PDFs, inspection reports, financial models).

Context Decay: When a deal lead leaves the firm, the specific learnings from their market analysis leave with them.

The SAGE Edge

Unified Logic: SAGE ingests disparate sources to generate a unified, scored investment profile. It normalizes data, allowing apples-to-apples comparison.

Shared Brain: The reasoning logic is centralized. Learnings from one deal can be updated in the system logic, immediately benefiting all future analyses across the firm.

Frictionless Knowledge Transfer: New employees access the firm's collective intelligence immediately through the platform.

Decisions as Assets

Decision-making should no longer be treated as unmanageable chaos. With SAGE, organizations stop leaking institutional knowledge and begin building a defensible, auditable history of their strategic logic.

A Look Ahead: Precedent

SAGE is the engine that drives intelligent action. However, intelligence without retention is inefficient. To fully address the challenge of organizational amnesia, a decision maker must be paired with a decision keeper. We are currently finalizing a companion infrastructure designed to serve as the ultimate system of record for business logic.

Coming Soon